Executive Pensions

The Company sets up the Pension and pays the premium on behalf of the members i.e. company directors and/or employers.

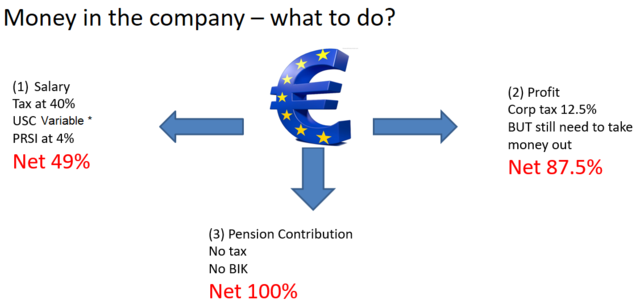

As a Company Director If you withdraw money from the company, you pay, income tax, PRSI and USC. If you leave it in the company, you pay Corporation tax, however, if you divert it into a Pension Fund then you do not pay any tax.

Any money paid into a pension plan is classified as a business expense.

In addition to this, the Pension fund grows tax free and you can withdraw a tax free lumpsum at retirement.

Who can take out an Executive Pension?

Anyone over the age of 18 who is working and not a member of a company Pension Scheme

When can I draw down the Benefits?

With an Executive Pension, you can draw down the benefits anytime between the ages of 60 and 70. You can still be working when you draw down the benefits.

You can draw down the benefits before the age of 60 if its due to ill health.

You can draw down the benefits from age 50 if you have left the company

What do I get at retirement?

You can actually draw the entire fund tax free if it is equal to or less than 1.5 times final salary.

This is subject to having 20 or more years’ service completed with the company and being age 60 or over. Only members of a company pension have this option and some company directors and employees only fund for this option.

Alternatively, if you have a larger fund you can take a Tax Free Lumpsum equal to 25% of the Pension Fund. The remaining balance of 75% of the Fund is used to provide an additional income on top of the state pension. The remaining balance can be re-invested in a post-retirement product called an ARF (Approved Retirement Fund), can be used to purchase a guaranteed income for the rest of your life (pension) OR can be taken as a cash lumpsum. Any withdrawals from the 75% balance are subject to tax, USC etc. (if over a certain amount – currently a person over 65 can earn €18,000 pa tax free including the state pension)

Revenue Max Contribution:

The max contribution you can make to a Personal Pension currently and claim tax relief based is based on age, the older you get, the more Revenue allow you to contribute as follows:

Under age 30 = 15% of earnings

30 to 39 = 20% of earnings

40 to 49 = 25% of earnings

50 to 54 = 30% of earnings

55 to 59 = 35% of earnings

60 and over = 40% of earnings

How do I get started?

Call us today on 059 913 3800 to arrange a Free Pension Consultation.

Need Some Guidance?

Call us on:

Tel: (059) 913 3800